This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

The road ahead: Inside the trends defining the future of luxury cars

By Rory FH Smith | 30 July 2025 | Cars & Yachts, Motoring, Speed

As new technologies, political upheavals and customer expectations continue to evolve, what really is next for the automotive industry? Tempus explores the vital trends to know

It’s a tough time to be a carmaker: trade wars, punishing tariffs, a complicated energy market and new technology developing by the day. In an industry where it takes years for luxury cars to go from concept to road-going reality, it’s a battle for car brands to keep up and stay ahead of the competition, let alone consumer expectations. Given the pace of change in society, the economy and technology, it’s no surprise to learn that the way we move about on the road is undergoing a radical transformation.

It’s a tough time to be a carmaker: trade wars, punishing tariffs, a complicated energy market and new technology developing by the day. In an industry where it takes years for luxury cars to go from concept to road-going reality, it’s a battle for car brands to keep up and stay ahead of the competition, let alone consumer expectations. Given the pace of change in society, the economy and technology, it’s no surprise to learn that the way we move about on the road is undergoing a radical transformation.

“Vehicles are no longer just modes of transportation; they are designed to feel distinct and to embody the identity of the brands that create them,” says Luke Miles, founder of New Territory, an independent brand experience studio. “As consumer expectations evolve, the car itself is transforming into a host for its audience, offering immersive experiences that go beyond traditional functionality.”

Given the testing times and changing tides, more manufacturers are aiming upwards, creating a new golden age of luxury cars that push the boundaries of what’s possible in terms of tech, performance, look and feel. With the global luxury car market burgeoning and new brands emerging alongside the automotive establishment, what exactly does the future hold for road-going luxury transportation?

Related: Taking the Ferrari Purosangue on a road test like no other THE GREAT ENERGY DEBATE | COMBUSTION, HYBRID, ELECTRIC OR HYDROGEN?

THE GREAT ENERGY DEBATE | COMBUSTION, HYBRID, ELECTRIC OR HYDROGEN?

The great energy debate rages on when it comes to balancing sustainability with practicality and desirability on the road. Electrification has been the buzzword (excuse the pun) for most car brands for more than a decade, as the switch to fully electric vehicles (EVs) looked imminent.

While electric still appears to be the end goal when it comes to the cars of the future, consumers have momentarily cooled on the idea of a pure electric vehicle as legislators push back the deadline for a full EN adoption, shining a light on the hybrid middle ground, which blends both combination and electric. In the UK, the policy shift means hybrids will be sold until 2035 while ‘micro-volume’ carmakers such as Aston Martin, Bentley and McLaren are exempt from the EV sales quotas. “The industry is on the way to electrification and one of our most important strategic tasks is to manage this,” says Bentley CEO and chairman Frank-Steffen Walliser. “Now, plug-in hybrid is a very important milestone in our journey to electrification – it’s not just another bridging technology – our customers have not only accepted the move to hybrid, they really love it. We’ve had a lot of very positive feedback on that.”

“The industry is on the way to electrification and one of our most important strategic tasks is to manage this,” says Bentley CEO and chairman Frank-Steffen Walliser. “Now, plug-in hybrid is a very important milestone in our journey to electrification – it’s not just another bridging technology – our customers have not only accepted the move to hybrid, they really love it. We’ve had a lot of very positive feedback on that.”

As for hydrogen, brands like Toyota, Honda, Hyundai and BMW have got behind the technology, developing new fuel cell vehicles (FCEVs) and enhancing hydrogen infrastructure but it’s far from the same level of attention plug-in electric vehicles have received, particularly when it comes to luxury. Despite the advancements in fuel cell technology, challenges remain, such as high production costs and safety concerns. SUSTAINABILITY | THE RISE OF THE LIGHTWEIGHT

SUSTAINABILITY | THE RISE OF THE LIGHTWEIGHT

If there’s one consistent trend in the development of cars over the past century, it’s their increasing size and weight. Today, a Mercedes-Benz EQS SUV has a weight of close to three tonnes, while the first-generation Mercedes S-Class from the 1970s weighed less than two. While much of that weight comes from the unparalleled levels of technology and tricks that modern luxury cars offer, the weight gain also comes from the engineering that underpins them, particularly when it comes to electric cars.

“Electric cars are very heavy, a typical one is two and a half tonnes, whereas our cars are around 1000 kilograms,” says Phil Lee, CEO of Gordon Murray Automotive, makers of the V12-engined T.50 supercar.

“If the car is lighter, you don’t have to move all that mass around, and batteries are heavy,” he explains. “Hybrid can be a solution but the main thing is to make sure that the cars stay light.”

With a history of designing Formula One cars, Gordon Murray is well versed in the improved efficiency and performance of lightweight vehicles but more mainstream luxury manufacturers are following suit. Alpine has its peppy A110 two-seater sportscar, which weighs just 1.102kg. Morgan recently revealed its new 1.170kg Supersport and this year the market welcomed new British start-up Longbow, which plans to produce two sub-1000kg Featherweight Electric Vehicles’ (FEV) by 2026.

Related: Salon Privé announces 20th anniversary concours entries AUTOMATION | TO DRIVE OR BE DRIVEN?

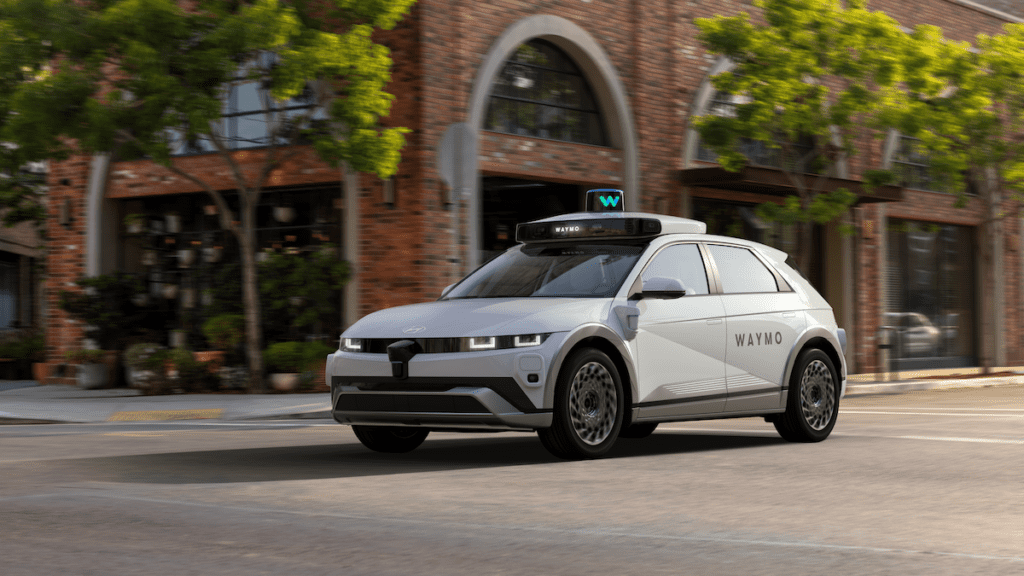

AUTOMATION | TO DRIVE OR BE DRIVEN?

Most cars on sale today boast some level of autonomy, such as autonomous emergency braking and systems that adapt the vehicles speed but the mass-adoption of full, ‘hands and eyes-off’ autonomy in everyday life is still some way off. Uber is trialling taxis without drivers across the US and the technology looks destined to hit UK roads next, after the Automated Vehicles Act was introduced in 2024, paving the way for the first self-driving cars to appear on our roads by the end of 2026. With drivers relieved of their duty, there are “significant opportunities for both manufacturers and consumers”, says Luke.

“With autonomous capabilities reducing the need for driver engagement, vehicles can become flexible, multipurpose spaces designed for productivity, relaxation or entertainment,” he adds. “This shift allows manufacturers to adopt a hospitality-first mindset – like a fine hotel, curating experiences that cater to individual passenger needs. The flexibility enables brands to rethink everything, from seating arrangements to personalised digital services, ensuring that the vehicle serves as an intuitive, responsive host.” In the luxury world, where customer experience is everything, the ‘hospitality mindset’ will become a space for differentiation, with experiences served at every touchpoint – from the point of enquiry and purchase all the way through to ownership.

In the luxury world, where customer experience is everything, the ‘hospitality mindset’ will become a space for differentiation, with experiences served at every touchpoint – from the point of enquiry and purchase all the way through to ownership.

When it comes to brands that pride themselves on performance and undiluted driving experiences, the path to automation is less clear cut. With Aston Martin recently embracing its new “Intensity.Driven” strapline, the great British carmaker is dialling up the idea of driving as an experience but it’s likely performance car makers will need to balance this with increasing levels of autonomy.

Afterall, wouldn’t you be happy to hand over the driving duties during a monotonous motorway slog and then take it back when the opportunity for a B-road blast emerges? PERSONALISATION | THE GROWTH OF BESPOKE

PERSONALISATION | THE GROWTH OF BESPOKE

As the market for luxury cars continues to grow, so do owners’ appetites for individuality and more bespoke vehicles. In 2024, Ferrari raised its earnings forecast for the year, attributing the growth to high sales of premium models and a surge in demand for personalised features, which the marque claimed accounted for about 19% of its 2023 revenue.

Similarly, Bentley and Rolls-Royce have reported increased profits due to the personalisation trend, with both marques dialing up their bespoke coachbuilding divisions over the past decade. Limited to only the most affluent and dedicated owners, both companies create special limited-editions, such as the £2m Bentley Batur and the Rolls-Royce Droptail, which is rumored to cost in the region of £25m apiece.

“Personalisation will be key, says Luke. “With vehicles acting more like hosts, being able to adjust to individual preferences and creating a deeper connection between the car and its occupants is crucial.”